The Economist has a very interesting article on the growing number of currency unions in Africa. It talks about the differences between the unions, their chances for the future and of course, being The Economist, their biggest threats.

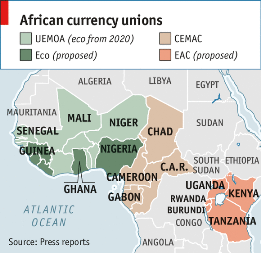

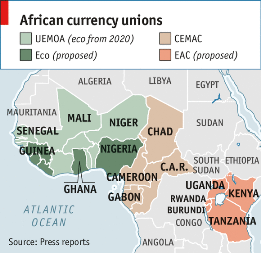

THE euro crisis has put most people off currency unions. But not in Africa, it seems. In November the leaders of five countries of the East African Community (EAC) agreed to form a monetary union within ten years. A month before West African politicians agreed on a plan to introduce a new shared currency, the eco, over the next few years. It should eventually subsume West Africa’s existing currency bloc—but not its central African cousin.

THE euro crisis has put most people off currency unions. But not in Africa, it seems. In November the leaders of five countries of the East African Community (EAC) agreed to form a monetary union within ten years. A month before West African politicians agreed on a plan to introduce a new shared currency, the eco, over the next few years. It should eventually subsume West Africa’s existing currency bloc—but not its central African cousin.

Under the proposal an initial group of six countries will adopt the eco by 2015 (see map). Five years later the members of the West African Economic and Monetary Union (known as UEMOA, its French acronym), which currently share a currency called the West African CFA franc, are to adopt the eco too, creating a currency union of over 300m people.

West African politicians are pushing for further integration because they, like most economists, argue that the single currency for UEMOA has been a qualified success. UEMOA member states are more fiscally disciplined than their neighbours outside the currency zone, says Cécile Couharde of the University of Paris Ouest Nanterre La Défense. The French government currently underwrites the West African CFA franc by guaranteeing to convert it to euros at a ratio of one to 0.0015. That has provided a stability rare in African currencies. Monetary unions also simplify trade: UEMOA has more intraregional trade than any other region in Africa, according to an IMF paper.

But the currency union has downsides. UEMOA economies move at different speeds. According to research by Romain Houssa, at the Catholic University of Leuven in Belgium, economic changes are poorly correlated between member states. From 2007 to 2012, the IMF found, the correlation between the business cycle of Senegal, a country with strong trade links outside the zone, and the other countries in UEMOA was almost zero.

Consequently, a UEMOA-wide interest rate is not ideal: as in the euro zone, some countries end up with the wrong rate. And an inflexible exchange rate makes economic adjustment difficult. From 2000 to 2012 average annual growth in output in UEMOA countries was about half that of comparable sub-Saharan economies, according to Gianluigi Giorgioni of Liverpool University.

Whereas UEMOA’s currency union has drawbacks, the proposed eco zone may have fatal flaws. It would encompass even more economic diversity. Nigeria in particular stands out. Its economy is huge by its neighbours’ standards. UEMOA’s GDP is about $75 billion; Nigeria’s is about $260 billion. The GDP of the next-biggest economy in the region, Ghana, is about $40 billion. And the Nigerian economy is unusual. Unlike most other West African countries it is heavily dependent on oil, which accounts for over a third of output, according to data from the OECD, a club of mostly rich countries.

IMF research shows that Nigeria’s balance of trade tends to move in the opposite direction to its neighbours’—they are largely importers of oil. During periods of high oil prices Nigeria may push for interest-rate rises. That would be disastrous for other eco-zone economies, which are likely to be gasping for lower rates.

To make matters worse the eco might be vulnerable to speculative attack. France would be unlikely to guarantee it, reckons Mr Giorgioni, as the liabilities would be large and the countries involved are not former French colonies. Without such support, investors would be nervous. Any fiscal laxity would be punished. If a region as rich as the euro zone has struggled to cope with such pressures, the likelihood that the poorer and less well-governed places hoping to adopt the eco could is tiny.

(© The Economist)

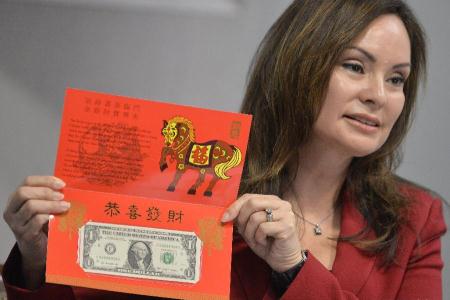

The US Bureau of Engraving and Printing (BEP) has once again released a special folder containing a one dollar banknote. To celebrate the Year of the Horse and honor the Chinese Lunar New Year, the BEP has printed crisp uncirculated $1 notes with serial numbers beginning with "8888", which pronounced in Chinese sounds like the word for "prosper" and is considered by many to be especially lucky. The product is further limited to 88,888 units. Year of the Horse Lucky Money $1 notes are priced at $5.95 each and are placed in a red folder. If you want one yourself, you can visit the shop here.

The US Bureau of Engraving and Printing (BEP) has once again released a special folder containing a one dollar banknote. To celebrate the Year of the Horse and honor the Chinese Lunar New Year, the BEP has printed crisp uncirculated $1 notes with serial numbers beginning with "8888", which pronounced in Chinese sounds like the word for "prosper" and is considered by many to be especially lucky. The product is further limited to 88,888 units. Year of the Horse Lucky Money $1 notes are priced at $5.95 each and are placed in a red folder. If you want one yourself, you can visit the shop here.

U.S. Treasurer Rosie Rios displays the "Year of the Horse" lucky money note during a press conference in Washington D.C.:

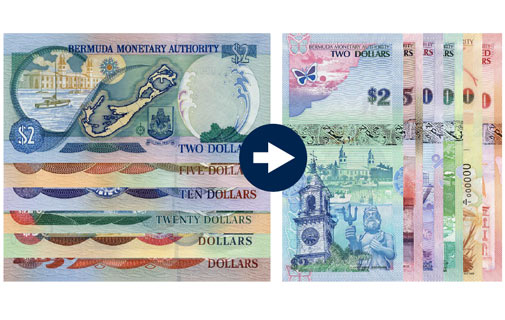

The Bermuda Monetary Authority has urged people to exchange their old horizontal banknotes for the new vertical notes. Shanna Lespere, Director of Operations at the Authority explained, "Back in June, the Authority announced that the legacy banknote series will no longer be legal tender after 31st December 2013. So the deadline is fast approaching. We have successfully been reducing circulation of these notes since that time, in conjunction with Bermuda’s banks. We strongly encourage everyone to visit their bank to exchange any legacy banknotes they may still have."

The Bermuda Monetary Authority has urged people to exchange their old horizontal banknotes for the new vertical notes. Shanna Lespere, Director of Operations at the Authority explained, "Back in June, the Authority announced that the legacy banknote series will no longer be legal tender after 31st December 2013. So the deadline is fast approaching. We have successfully been reducing circulation of these notes since that time, in conjunction with Bermuda’s banks. We strongly encourage everyone to visit their bank to exchange any legacy banknotes they may still have."

Important dates for the calling in period include:

Up to 31st December 2013

- The public may use the legacy banknotes to purchase goods and services.

- The public may also exchange legacy banknotes at their bank (i.e. the banks will exchange banknotes for their existing customers) or at the Bermuda Industrial Union Member’s Credit Union (if they are a member). "It is very important to note that the public cannot exchange notes at retail shops or any other cash business," added Mrs. Lespere. "They also cannot exchange the notes at the Bermuda Monetary Authority."

As of 1st January 2014

- The legacy banknotes will no longer be legal tender (i.e. they cannot be used to purchase goods

and services).

- The public has ten years to exchange legacy banknotes at their bank or at the Credit Union.

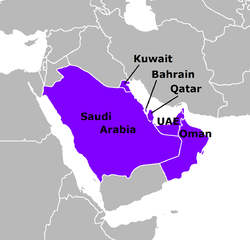

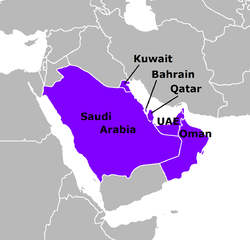

After the recent news on the proposed single currency for East Africa, could there be another group of countries moving towards a single currency? The Gulf Cooperation Council (GCC) consists of Bahrain, Kuwait, Qatar, Saudi Arabia, the United Arab Emirates and Oman. These six countries have been discussing a currency union similar to the Eurozone for more than 15 years. There was once even a name for the currency: the Khaleeji. That currency was turned down however in 2009 and talks seemed to go nowhere from then on. Sometimes they agreed on a single currency, then one country said no, then two countries etc. Eventually Oman and the United Arab Emirates pulled out of these talks altogether.

After the recent news on the proposed single currency for East Africa, could there be another group of countries moving towards a single currency? The Gulf Cooperation Council (GCC) consists of Bahrain, Kuwait, Qatar, Saudi Arabia, the United Arab Emirates and Oman. These six countries have been discussing a currency union similar to the Eurozone for more than 15 years. There was once even a name for the currency: the Khaleeji. That currency was turned down however in 2009 and talks seemed to go nowhere from then on. Sometimes they agreed on a single currency, then one country said no, then two countries etc. Eventually Oman and the United Arab Emirates pulled out of these talks altogether.

Now after a few years of silence on the subject, there is all of a sudden a rumour that the single currency will be announced at the end of December. This common currency to be announced by Bahrain, Kuwait, Qatar and Saudi Arabia would be pegged to the dollar, an anonymous source close to decision-makers said.

In September, an official of the European Central Bank (ECB) said that the GCC should not introduce a common currency before its members have a clear common objective. Yves Mersch, an executive board member of the ECB, reportedly said at a global financial summit that no union of states would be ready for a common currency if there was no political consensus. The Wall Street Journal, which also reported on the matter, states: "... analysts and observers are mostly sceptical of this happening anytime soon. For one, they say, there has been no news that significant progress has been made toward a monetary union."

The GCC itself denounced the rumours last night, saying: "The Monetary Council affirms that the reports by some newspapers and websites over the date of the issuing of the single Gulf currency are completely false, not based on accurate information nor reliable sources".

After the recent acquisition of the new Canadian 5 dollar with its space themed backside, I showed the note to a colleague who is also an amateur astronomer and writes for a Dutch blog on astronomy and the world of space exploration. His enthusiasm gave me the idea for a special theme blog on space and astronomy banknotes.

My goal is to compile an overview of banknotes which have a theme or show objects related to space, astronomy, satellites, astronomers, telescopes, observatories and so on. You can find this special blog by clicking the banner on the right or below.

The first three banknotes have been posted:

On 4 December 2012 Norway announced that the process of developing a new banknote series had officially started. The first step for the Norges Bank was to choose a theme for the new series. Once the theme had been approved, the national bank would choose the main elements of the banknotes' design.

On 4 December 2012 Norway announced that the process of developing a new banknote series had officially started. The first step for the Norges Bank was to choose a theme for the new series. Once the theme had been approved, the national bank would choose the main elements of the banknotes' design.

That theme has now be chosen and it´s The Sea, reflecting its importance for Norway's business sector and economic prosperity. This is from the press release:

Norges Bank started work on the new banknote series in autumn 2012. This will be the eighth series. There is a need to enhance banknote security to ensure that current and future Norwegian banknotes are resistant to counterfeiting. The work is well underway and a number of important decisions concerning the new series were made by Norges Bank's Executive Board in the fourth quarter of 2013. The theme, denomination breakdown, material, colours, language and size of the notes have now been decided.

"Finding a theme for the new banknote series has been an extensive and exciting process, with a creative input of ideas from various contributors," says Trond Eklund, Director of Norges Bank's Cashier's Department.

Norges Bank has sought to find a theme that runs through the banknote denominations, binding them together into a banknote series. "The Sea" provides a virtually infinite array of visual possibilities. The theme will be reflected both on the obverse and reverse face of the notes, breaking with the tradition of portraiture.

"We have chosen a theme we consider to be original and particularly relevant for Norway, which is a small country but a major coastal nation. Norway has a total coastline of 83 000 km, the longest in Europe. The use of marine resources, combined with the use of the sea as a transport artery, has been crucial to the development of Norway's economy and society," says Eklund.

The current denomination breakdown of 50 – 100 – 200 – 500 – 1000 and the current main colours will be retained for the new series. All the notes, which will be printed on cotton paper, will be 70 mm in height, but the width will increase with each denomination by 7 mm. This means that the 50 krone note will be 126 mm wide, while the 1000 krone note will be 154 mm wide. The Bank's official name will continue to be written in Norway's two official written languages, Bokmål and Nynorsk, i.e. Norges Bank and Noregs Bank.

In order to attract as many creative and interesting design proposals as possible, Norges Bank is now in the process of launching a design competition. The competition will be run in two stages; first a pre-qualification competition and then the final competition between five to eight participants to select the winning design.

No word yet on a timeline or a proposed date of issue.

The member states of the East African Community (Burundi, Kenya, Rwanda, Tanzania and Uganda) have signed a monetary-union deal. One aspect of this deal is a 10-year timeline for the establishment of a regional single currency. The agreement is the result of nearly a decade of talks. The member states will now try to establish institutions (like a regional central bank and a statistics body) to support the single currency.

The member states of the East African Community (Burundi, Kenya, Rwanda, Tanzania and Uganda) have signed a monetary-union deal. One aspect of this deal is a 10-year timeline for the establishment of a regional single currency. The agreement is the result of nearly a decade of talks. The member states will now try to establish institutions (like a regional central bank and a statistics body) to support the single currency.

"With a total population of about 135 million people, East Africa is becoming an investment magnet following a flurry of natural-gas and oil discoveries. Uganda and Kenya have discovered huge amounts of oil, while Tanzania boasts of huge natural-gas reserves. International companies have already started exploiting these resources, and the region is poised to become the next major energy hub in Sub Saharan Africa."

The Central Bank of Moldavia has issued a commemorative banknote on 29 November 2013. The note commemorates the 20th anniversary of the national currency.

The Central Bank of Moldavia has issued a commemorative banknote on 29 November 2013. The note commemorates the 20th anniversary of the national currency.

The note is the same as the existing 200 lei note but has an added line of text: "20 DE ANI". Only 200,000 copies have been printed.

Several news agencies report that the Central Bank of Tunisia has issued a new 10 dinar note yesterday 28 November 2013. The blue note's dimensions are 148 mm x 73 mm. It features images of Abou El Kacem Chebbi on the front and El Medersa El Bachia on the back. There are numerous security features added like intaglio printing, watermarks, a holographic strip, latent images, micro-letters, metallic parts, Omron circles and iridescent ink.

Several news agencies report that the Central Bank of Tunisia has issued a new 10 dinar note yesterday 28 November 2013. The blue note's dimensions are 148 mm x 73 mm. It features images of Abou El Kacem Chebbi on the front and El Medersa El Bachia on the back. There are numerous security features added like intaglio printing, watermarks, a holographic strip, latent images, micro-letters, metallic parts, Omron circles and iridescent ink.

The new banknote will circulate concurrently with other issues.

Japan's Ministry of Finance has launched a promotion campaign in the hope of attracting orders to print banknotes for other economies, press agency Bernama reports:

Japan's Ministry of Finance has launched a promotion campaign in the hope of attracting orders to print banknotes for other economies, press agency Bernama reports:

Through the National Printing Bureau under its jurisdiction, the ministry hopes to attract such orders by highlighting Japan's cutting-edge anti-counterfeit technologies, sources said. The ministry is also offering a service for printing passports. Currently, the bureau prints Japanese bank notes. In the post-World War II period, Japan printed paper money for South Korea during the Korean War but has no other experience in printing money for other countries.

The bureau has set up a sales office to promote its services to governments and central banks overseas. It has sent officials to a number of emerging economies including Mongolia, Palau and Bhutan and plans to make sales efforts in other countries. The bureau is studying whether there are any plans by other countries to change their bank notes and solicit bids, the sources added.

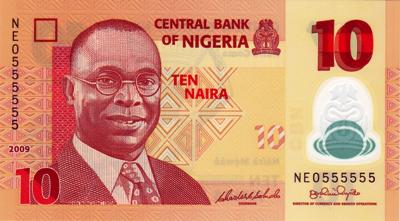

Article from 23 April 2013: The Central Bank of Nigeria has announced it will stop the production of polymer notes and will return to paper banknotes. The main reason for this step is the fading of the banknotes, especially the smaller denominations. The Central Bank had organised numerous campaigns educating the public on the use of banknotes but apparently to no avail.

Article from 23 April 2013: The Central Bank of Nigeria has announced it will stop the production of polymer notes and will return to paper banknotes. The main reason for this step is the fading of the banknotes, especially the smaller denominations. The Central Bank had organised numerous campaigns educating the public on the use of banknotes but apparently to no avail.

The deputy governor has announced that production of new polymer notes has already been cancelled. By the middle of of 2013 the bank will begin producing paper money again, starting with the lower denominations.

Update 27 november 2013: Nigeria has again confirmed that the production of polymer notes will be cancelled. "The Central Bank of Nigeria (CBN) signed a deal in 2006 with Australia's Securency International to print lower more-circulated units of the naira in polymer, while higher denominations were kept in paper form. But six years down the line -- and after allegations that the manufacturer bribed foreign officials to secure contracts, including in Nigeria -- the CBN said it was being forced to reverse the policy."

The decision to switch back to paper notes is questioned by many experts since the current trend is to convert to polymer. The issuing of paper notes is expected to begin in 2014 with the new notes printed by the state-run Nigerian Security Printing and Minting Company.

Joyous tidings dear readers for I, Steven Bron, have added the 200th country to my collection. And the 201st! I have also managed to get one of the best looking banknotes issued this year: the new Canadian 5 dollar. So a very good update! Four new notes have been added, starting with the two newcomers:

Joyous tidings dear readers for I, Steven Bron, have added the 200th country to my collection. And the 201st! I have also managed to get one of the best looking banknotes issued this year: the new Canadian 5 dollar. So a very good update! Four new notes have been added, starting with the two newcomers:

The European Central Bank had already announced that the new 10 euro note would be issued in 2014. Now they've given a new date to look forward to: 13 January 2014. On that day the design of the new banknote will be unveiled.

The European Central Bank had already announced that the new 10 euro note would be issued in 2014. Now they've given a new date to look forward to: 13 January 2014. On that day the design of the new banknote will be unveiled.

The ECB announced this happy news today at a seminar launching a Eurosystem Partnership Programme which has been set up for banknote equipment manufacturers and suppliers as well as clients and users.

This will be the second issue in the new Europa series. The new note will be issued later next year. When exactly? The new 5 euro note was presented on 10 January 2013 so if they keep more or less the same presentation and issue dates, you would expect the new 10 euro around May 2014. At this site however the ECB says it will "distribute leaflets about the new banknotes to points of sale across the euro area at the end of June 2014, ensuring cash handlers have ample opportunity to prepare for their circulation." So this probably means the new 10 euro will be available in the second half of 2014, even "after the summer".

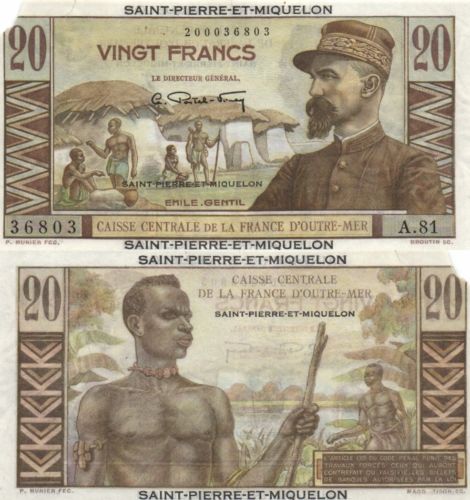

After last weeks new addition of Tannu Tuva I received a banknote from another new country this week and again it's a pretty unknown note issuing 'country' to most people: Saint-Pierre-et-Miquelon.

After last weeks new addition of Tannu Tuva I received a banknote from another new country this week and again it's a pretty unknown note issuing 'country' to most people: Saint-Pierre-et-Miquelon.

Saint-Pierre-et-Miquelon's official name is: collectivité territoriale de Saint-Pierre-et-Miquelon. It's a self-governing territorial overseas collectivity of France, situated in the northwestern Atlantic Ocean near Canada. It is the only remnant of the former colonial empire of New France that remains under French control. The islands are situated at the entrance of Fortune Bay, which extends into the southern coast of Newfoundland, near the Grand Banks.

As you can see in the scan the note is damaged and normally I wouldn't buy a note like that. The thing is though: banknotes from Saint-Pierre-et-Miquelon are pretty rare and therefore pretty expensive. This note still looks very decent (the non-damaged parts are almost UNC) and I could get this for a bargain. So I present you: the 20 francs (P24) from country number 199!

« Vorige Pagina |

Toon berichten 871-885 van 1227 |

Volgende Pagina »

THE euro crisis has put most people off currency unions. But not in Africa, it seems. In November the leaders of five countries of the East African Community (EAC) agreed to form a monetary union within ten years. A month before West African politicians agreed on a plan to introduce a new shared currency, the eco, over the next few years. It should eventually subsume West Africa’s existing currency bloc—but not its central African cousin.

THE euro crisis has put most people off currency unions. But not in Africa, it seems. In November the leaders of five countries of the East African Community (EAC) agreed to form a monetary union within ten years. A month before West African politicians agreed on a plan to introduce a new shared currency, the eco, over the next few years. It should eventually subsume West Africa’s existing currency bloc—but not its central African cousin.

The US

The US

The Bermuda Monetary Authority has

The Bermuda Monetary Authority has

After the recent news on the proposed

After the recent news on the proposed

On 4 December 2012 Norway

On 4 December 2012 Norway  The member states of the

The member states of the

The

The

Several news agencies

Several news agencies

Japan's Ministry of Finance has launched a promotion campaign in the hope of attracting orders to print banknotes for other economies, press agency Bernama

Japan's Ministry of Finance has launched a promotion campaign in the hope of attracting orders to print banknotes for other economies, press agency Bernama

Joyous tidings dear readers for I, Steven Bron, have added the 200th country to my collection. And the 201st! I have also managed to get one of the best looking banknotes issued this year: the new Canadian 5 dollar. So a very good update! Four new notes have been added, starting with the two newcomers:

Joyous tidings dear readers for I, Steven Bron, have added the 200th country to my collection. And the 201st! I have also managed to get one of the best looking banknotes issued this year: the new Canadian 5 dollar. So a very good update! Four new notes have been added, starting with the two newcomers:

The

The

After last weeks new addition of

After last weeks new addition of